At Exponent, we take responsible investing seriously. From the pensioners who entrust us with their savings to the employees who work at our portfolio companies, we have a duty to act responsibly. We do this by considering environmental, social and governance factors at all stages of the deal cycle.

Richard Lenane

Managing Partner

Our Approach

We believe that processes and procedures are never a substitute for individual responsibility. This same belief informs our approach to responsible investing. Our investment team seek to embed greater awareness and action on ESG issues in the operations of all our portfolio companies where, as board members, we are able to drive real change.

With a focus on ESG that starts from the Managing Partner and is supported by the Firm’s COO and a dedicated ESG Manager, we are committed to driving ESG across the Firm.

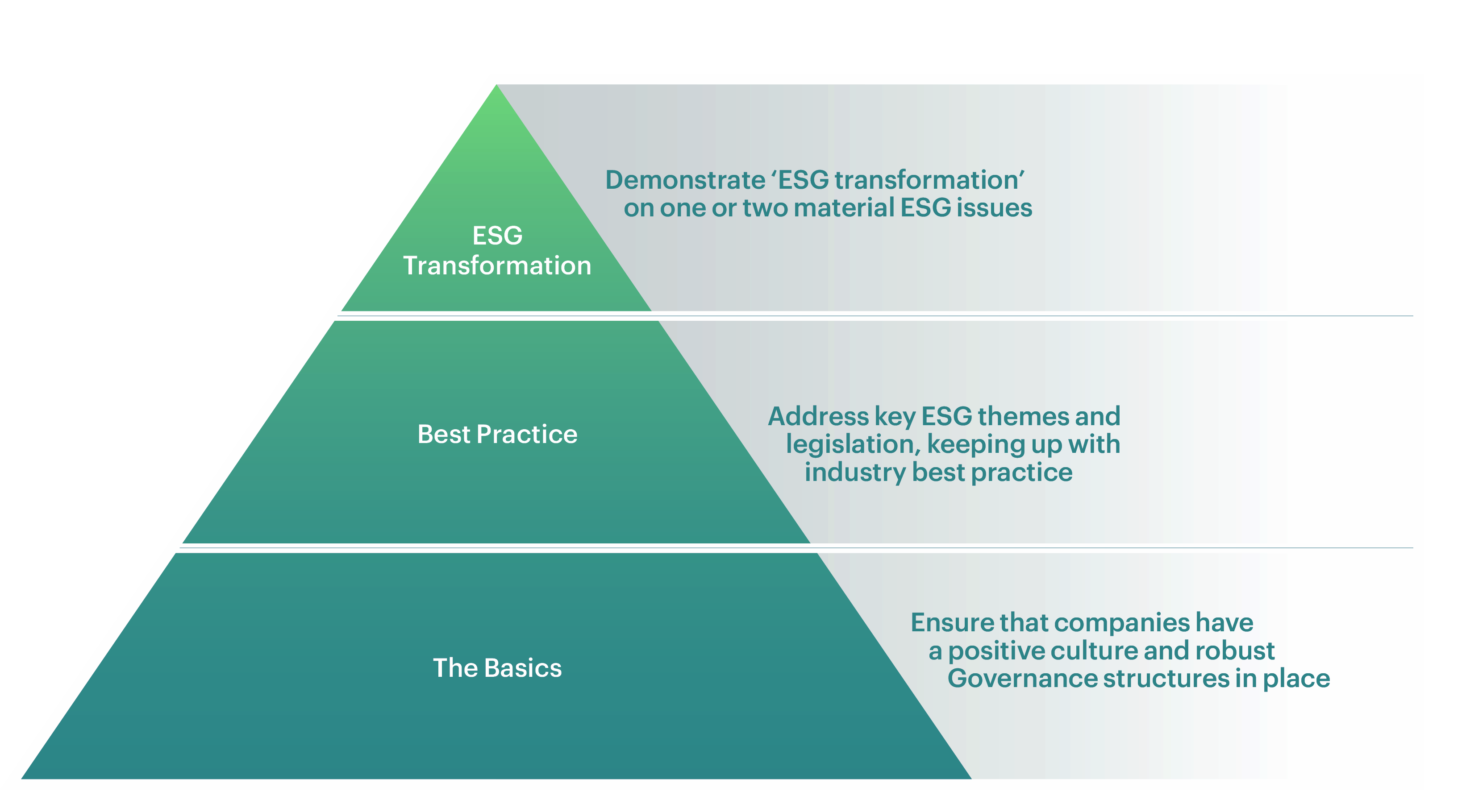

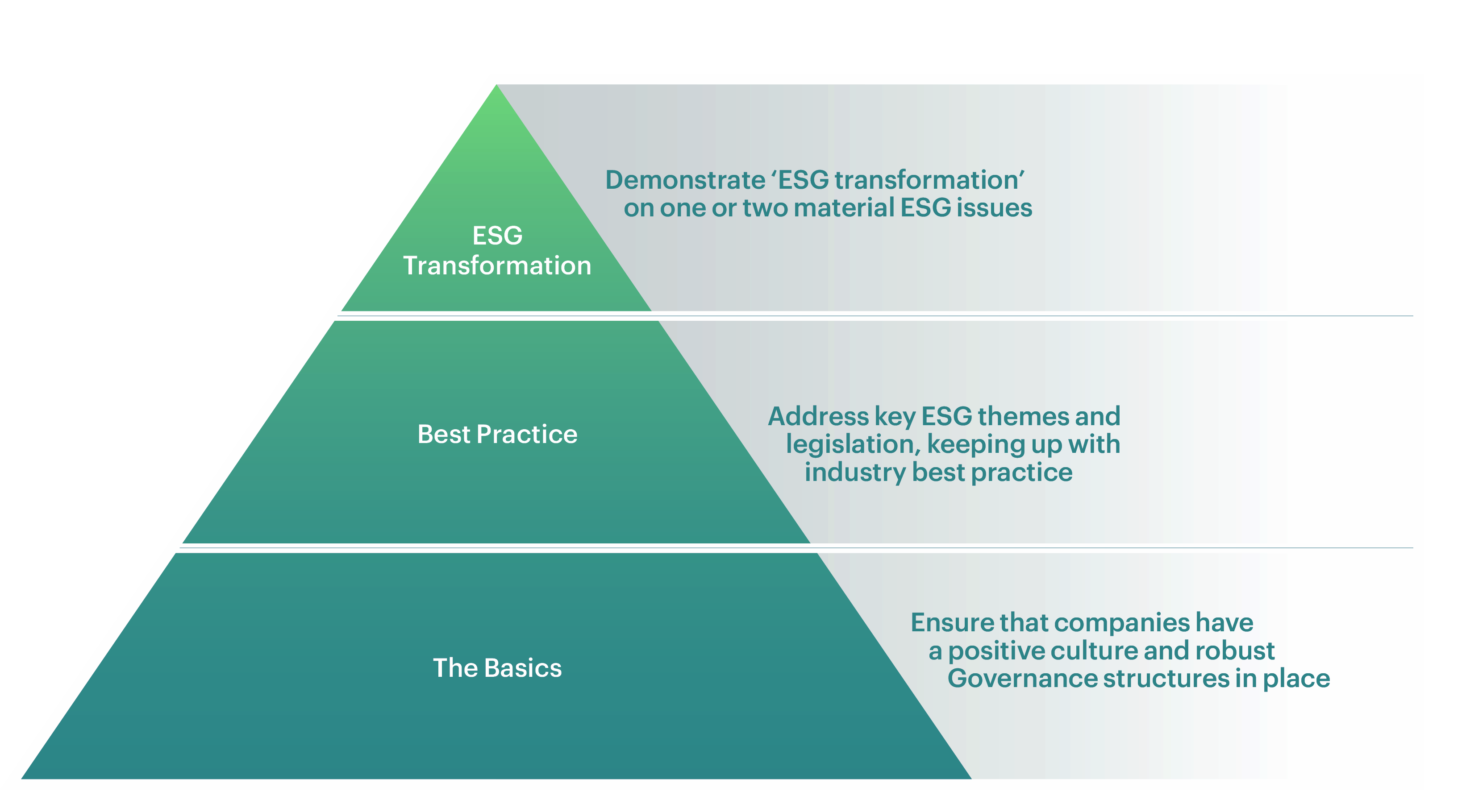

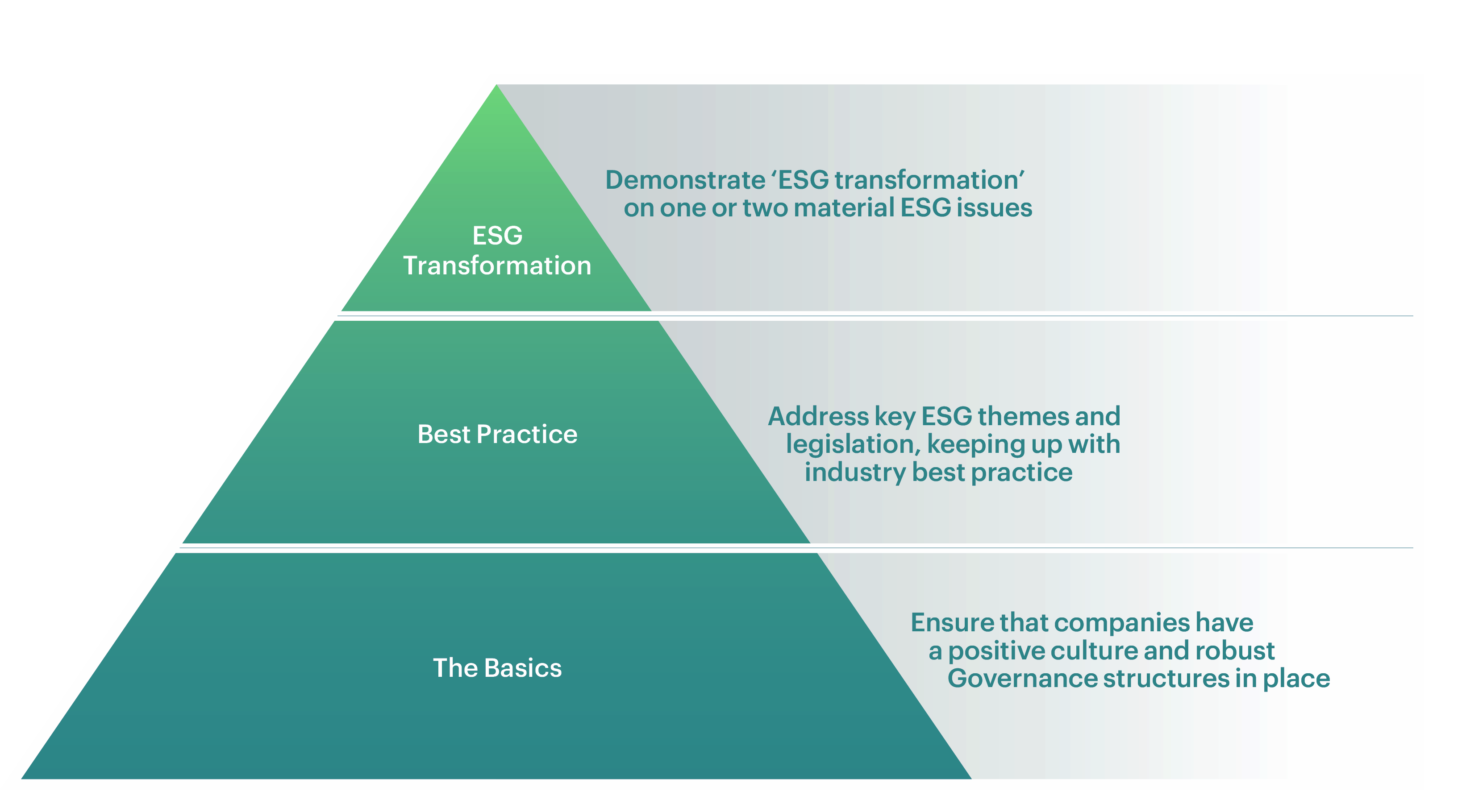

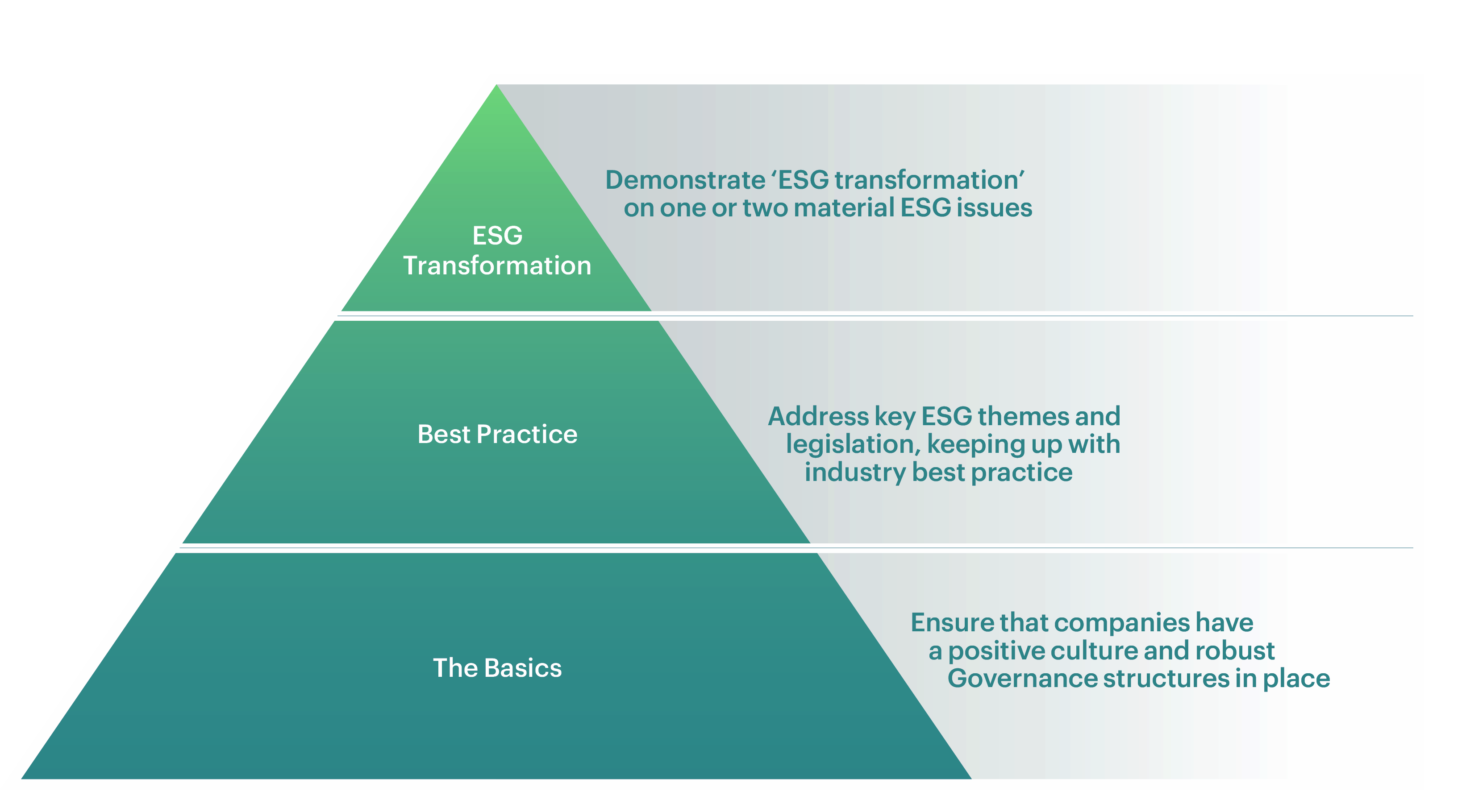

We are committed to supporting our portfolio companies on their ESG journey. We help them build a solid foundation with robust governance structures and assist them in achieving best practice by addressing key ESG themes and legislation; whilst ultimately challenging them to set targets and goals to demonstrate ESG leadership.

Contributing to best practice

Exponent contributes to industry activities and associations that promote best practice in our industry. We are members of the BVCA, and Invest Europe, bodies that uphold good practice in the private equity sector. We support Level 20, a non-profit addressing gender inequality. And we support Impetus, who fund and build charities that transform the lives of young people from disadvantaged backgrounds.

Our approach to Diversity, Equity & Inclusion

We recognise that our people are our most important resource. We’re continuing to evolve our approach to Diversity, Equality and Inclusion (“DE&I”) within the Firm because we understand the important role that an inclusive organisation can play in building a happy and productive workforce. We know that a fully representative workforce brings in diverse skills and disciplines, which help our Firm and Portfolio stay agile in a changing world.

We established our DEI Committee in 2020 to help guide the Firm’s DEI strategy. You can read more about our approach in our DEI Report.

Working to an independent framework

As a signatory to the PRI, Exponent is committed to its six principles of responsible investment: